Receivables Finance

Welcome to EximTradeFinance’s Receivables Finance Hub

We help businesses unlock working capital by turning unpaid customer invoices into immediate cash-through both recourse and non-recourse receivables financing options. Whether you're exploring factoring, invoice discounting, or want to understand how receivables finance fits into your broader trade strategy, this hub offers practical insights, tools and resources to support your growth.

Balanced Cash Flow for Buyers and Suppliers

Our model helps buyers extend their payment terms while ensuring suppliers receive early payment. This approach improves working capital for both parties, keeping inventory moving and production on track.

- What Is Receivables Finance

- How Do Receivables Arise

- How receivables finance finance works

- The Quality of the Receivable Matters

- How Can Receivables Be Financed

- Key Benefits of Receivables Finance

- How We Can Help

- Learn more about receivables finance

What Is Receivables Finance?

Receivables finance allows a business to access funds tied up in customer invoices. When a company sells goods or services on credit, the amount due becomes a receivable-an asset on the seller’s books and a liability for the buyer. Rather than waiting 30, 60, or 90 days for payment, the seller can receive early funds from a financier.

This accelerates cash flow, reduces the need for working capital and improves operational efficiency. Key metrics involved include:

DSO (Days Sales Outstanding): How quickly the seller turns receivables into cash.

DPO (Days Payable Outstanding): How long the buyer can delay payment without penalty.

How Do Receivables Arise?

Receivables are created every time a business sells a product or service on credit. In a typical supply chain, raw materials may pass through multiple hands-each sale generating a receivable. These receivables can be financed at any stage, offering liquidity for both upstream and downstream partners.

This is why receivables finance is central to many trade finance strategies - enabling businesses to fund production, manage cash flow and support growth at every link in the value chain.

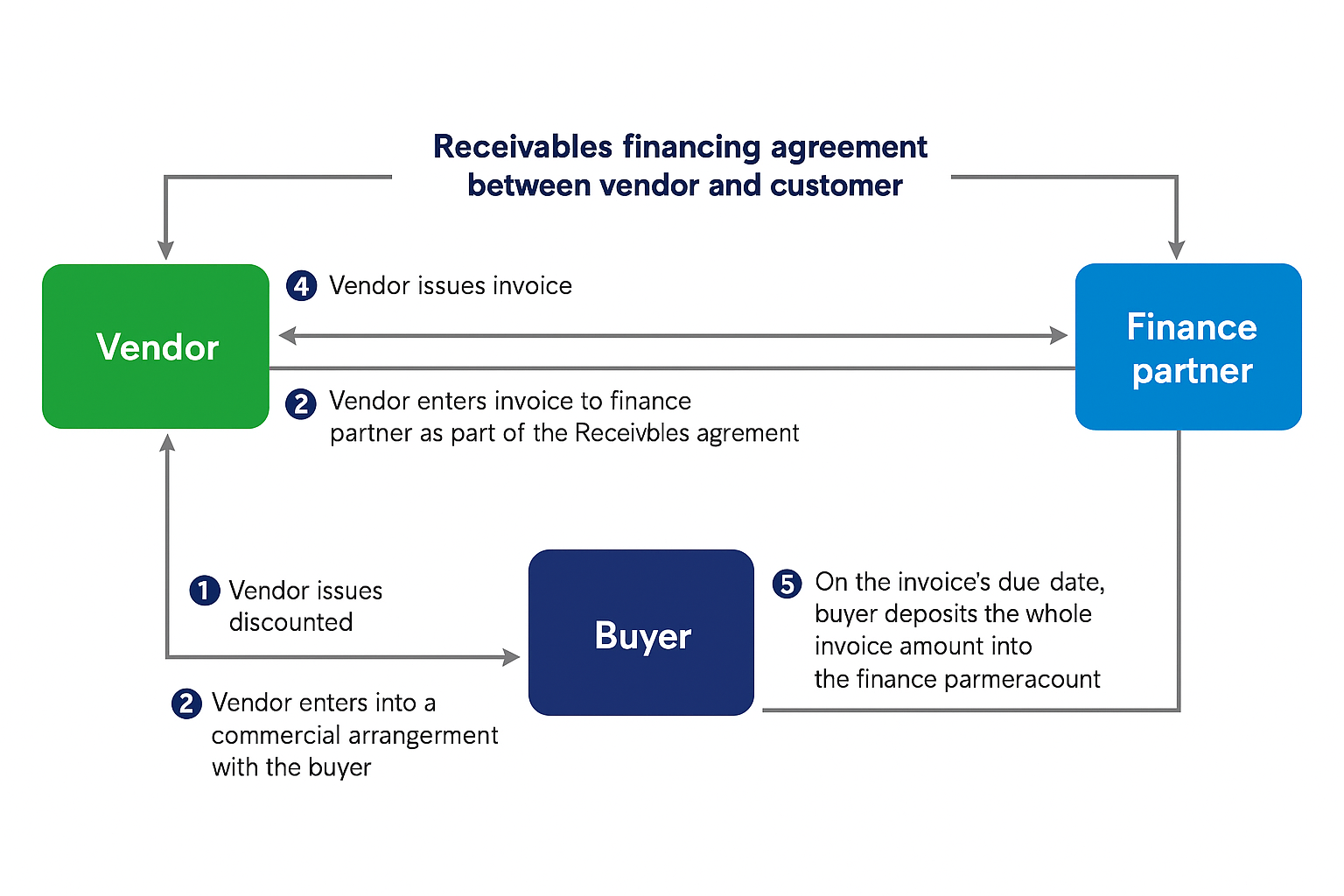

Diagram: How Receivables finance works

The Quality of the Receivable Matters

The strength and reliability of a receivable plays a critical role in determining how-and whether-it can be financed. Finance providers often seek credit enhancements such as buyer guarantees, credit insurance, or irrevocable payment commitments like promissory notes or payment undertakings. These reduce the risk of non-payment and improve the attractiveness of the receivable as a financial asset.

Receivables backed by clear payment obligations are more valuable and easier to fund. The closer a receivable is to being an unconditional promise to pay, the more financing options become available. In contrast, if a seller still has performance obligations to fulfill, some funders may hesitate to extend financing or may price in more risk.

Timing also matters: receivables with shorter maturity periods-like 30 days-are typically more favorable for funding compared to those tied to long production or shipping cycles.

How Can Receivables Be Financed?

Once a receivable becomes an unconditional obligation of the buyer, it can be financed based on the buyer’s credit risk. The method of financing-such as factoring, discounting, or securitization-depends on the structure of the transaction and the level of risk the finance provider is willing to take. The better the quality and clarity of the receivable, the easier and more cost-effective it is to secure financing.

Key Benefits of Receivables Finance

Improved Cash Flow: Get paid faster without waiting for customer payments.

Outsourced Credit Management: Some providers handle your sales ledger and collections.

Risk Mitigation: Funders often conduct due diligence on your customers and may offer credit protection.

Confidentiality Options: Solutions like confidential discounting keep financing arrangements private.

Supports Growth: Free up working capital to fulfill larger orders and expand operations.

How We Can Help

At EximTradeFinance, we partner with a network of over 270 global funders-including banks, lenders and alternative finance providers-to connect your business with tailored receivables finance solutions. Whether you're selling to local or international clients, our experts work with you to build flexible, scalable funding strategies.

From manufacturing to media, our sector-specific specialists help you navigate complex financing needs and unlock capital from outstanding invoices.

Want to learn more about receivables finance?

Explore our in-depth articles, expert interviews and real-world insights into receivables finance. Whether you're new to the concept or ready to expand your trade lines, our resources will guide you through the latest trends, tools and best practices.

FAQ'S

Both are types of invoice finance, but they differ in control and visibility:

- Factoring involves selling your invoices to a finance provider who manages your customer collections and often takes over your sales ledger. The customer is usually aware of the arrangement and businesses can typically receive up to 90% of the invoice value upfront.

- Invoice Discounting, on the other hand, allows your business to retain control of collections. It's often done confidentially, so customers may not know a finance provider is involved. Funds are advanced against a bulk value of invoices, with regular reconciliations. It’s ideal for companies with solid internal credit control systems.

The main distinction lies in who manages customer payments-the funder (factoring) or your business (discounting).

India – Mumbai

2nd Floor, Marine Drive, Express Towers,

Nariman Point, Mumbai, Maharashtra 400021